Personalized strategies that go beyond compliance — helping you stay financially organized, minimize tax liability, and achieve long-term success.

Proven expertise, practical strategies, and reliable support for every financial need.

Certified professional with extensive industry knowledge

Strong background with top-tier global firms

Proactive guidance available beyond every tax season

Tailored financial solutions for your unique goals

Our mission is to empower individuals and small businesses with trusted, high-quality tax and financial guidance. We are committed to providing personalized, strategic solutions that go beyond compliance — helping our clients make confident decisions, stay financially organized, and achieve long-term success.

Individual Tax Preparation & Planning

Business Tax Preparation & Planning

Ongoing Support & Year-Round Advisory

Business Entity Formation & Structuring

Financial Analysis & Advisory Services

FBAR (Foreign Bank Account Reporting) Compliance

Business Compliance & EIN Registration

Back Tax Filing & IRS Resolution Services

Financial Projection & Loan Preparation Services

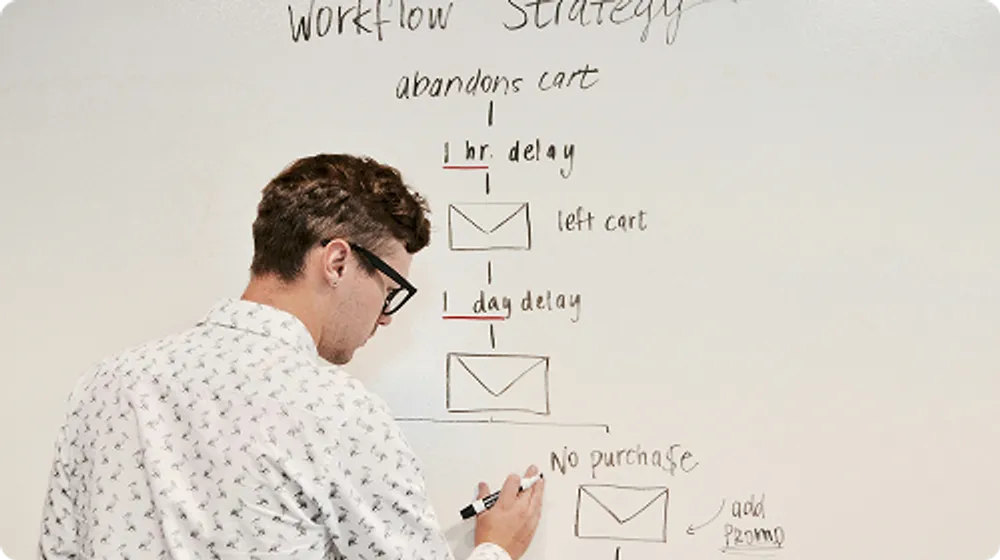

See how our approach differs from traditional tax and financial services

Get answers to common questions about our tax and advisory services

Yes, we prepare and file both federal and state tax returns for individuals and businesses. Our comprehensive service ensures all filing requirements are met accurately and on time.

Yes, we handle FBAR/FinCEN filings and provide guidance on international reporting compliance. We help minimize penalties through accurate and timely filing of all required international forms.

You can securely upload documents through our encrypted client portal. This ensures your sensitive financial information is protected while providing us with the documents we need to serve you effectively.

We specialize in flow-through entities including S Corporations, Partnerships, LLCs, and Sole Proprietorships. Our expertise in these business structures allows us to provide targeted advice and optimization strategies.

Absolutely. Unlike seasonal tax preparers, we provide year-round proactive tax planning and advisory services. This includes quarterly check-ins, tax strategy sessions, and ongoing support for any tax-related questions.

Most individual returns are completed within 3-5 business days. Business returns typically take 5-7 business days, depending on complexity.

Whether you're an individual looking for expert tax advice or a small business owner seeking strategic financial guidance, we're here to help. Reach out today to schedule a consultation and see how we can support your goals.

All engagements subject to terms. Secure portal ensures confidentiality.